While stocks, or public equities, typically grab the headlines for their performance—especially in a negative-return environment such as the one the financial markets are experiencing now—private equity investments have been growing in importance because of the diversification and solid returns this asset class can provide, even in down markets.

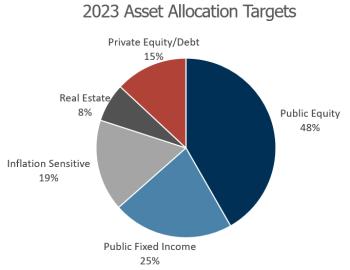

In December, SWIB’s independent Board of Trustees approved an asset allocation for the Core Trust Fund that remains similar to the allocation set for 2022, with the exception of an increase to private equity/debt from a target of 12% to 15%, and a reduction to public equities from a target of 52% to 48%. SWIB’s Board of Trustees annually reviews the asset allocation for the Core Trust Fund and has approved ranges for each asset class that allow for rebalancing, depending on the market environment.

One of the reasons for the allocation adjustment is private equity provides the benefits of a diversified portfolio and opens up investment opportunities that may otherwise not be available. Private equity offers investors access to private companies that otherwise would not be available to investors because they do not trade on stock market exchanges. These companies are often small, fast-growing businesses that can offer higher returns on investments.

Steven Kaplan, Neubauer Family Distinguished Service Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business, presented to SWIB Trustees and staff at their annual October Board workshop. He highlighted that over the past 20 years, as the number of public companies has declined, the private markets have grown, opening up new opportunities for investors.

In addition to providing portfolio diversification, private equity has a history of generating solid returns, which is important to pension funds like the Wisconsin Retirement System, as it becomes more challenging to meet their return targets. According to the American Investment Council’s 2022 public pension study, private equity delivered the strongest returns of any asset class for public pension portfolios. The report found that private equity investments delivered a median annualized return of 12.3% over a 10-year period for public pension funds across America that partner with private equity managers – a greater return than any other asset class, including public equities, which returned 11.2% over that same time period.

“When I looked at performance of the private equity—buyout and growth equity—markets over time, the results show that private equity has persistently outperformed the public equity markets over the last 30 years, regardless of how performance is measured and irrespective of the vintage year or stage in the market cycle,” Kaplan said. “And this outperformance holds even after taking account of the fees charged by the private equity managers.”

Despite the success of private equity investments in recent years, choosing the right private market investments is a challenge, Kaplan said. “While private equity as an asset class exhibits attractive performance characteristics, my research also shows that it is difficult to identify top-level managers on the basis of their prior fund performance. Therefore, consistently outperforming the average private equity fund is not easy,” Kaplan said.

SWIB’s Private Equity team has been successful in searching out and executing on successful opportunities in a competitive investment market since 1985, when SWIB became one of the first public pension managers to invest in private equity markets. According to State Street Global Markets, for each of the last ten vintage years, SWIB has finished in the second quartile when compared to peers. This strong performance emphasizes the importance of the experienced and highly skilled team SWIB has managing the asset class.

SWIB’s investment in private equity has supported the overall WRS investment strategy and provided solid returns for the Core Trust Fund, consistently outperforming public equities. Despite the down year for public equities that returned -18%, SWIB’s private equity portfolio in 2022 finished at over 6%. Over the last 10 years, SWIB’s private equity portfolio has returned just above 15%, again exceeding public equities, which returned over 8% over the same time period.

SWIB will continue to innovate to keep pace with an ever-changing investment management landscape by focusing on its thoughtful asset allocation, significant portfolio diversification, and active management to meet the long-term requirements of the WRS.