Summary

Use this form to name primary and secondary beneficiaries for your WRS Retirement Benefit and your Wisconsin Public Employers Life Insurance.

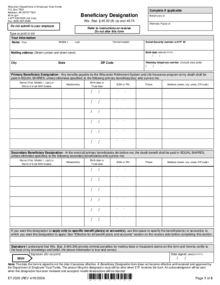

The Beneficiary Designation (ET-2320) form is divided into parts with details to help you understand the information. Click on a section to navigate to or scroll down to each section. After you finish a section, click on "Back to Top" to navigate to a new section. Follow along on your own form. If you do not have your own to look at, download the form above.

Make sure that your form is accepted by ETF by following these guidelines when entering your information:

5. Write the names of the first beneficiary(ies) you would like to receive your benefit after you die. You may name an individual(s), entity (such as a charity, business, religious organization, funeral home, etc.), trust, or estate. You may name more than one. All primary beneficiaries listed will receive EQUAL SHARES (equal amounts) of your benefit, unless you list different percentages. See the Naming a Beneficiary section for directions for naming a beneficiary. You must list the percentage in the same box as the beneficiary’s name.

Use the Beneficiary Designation - Alternate (ET-2321) if you want to specify who a primary beneficiary’s share will go to if they die before you do. For instance, if you name your three cousins as your primary beneficiaries, you can name the children of each cousin as alternate primary beneficiaries. Then, if one cousin dies before you do, their share will be divided between their children who are named as alternate primary beneficiaries.

6. Write the names of the main individual(s), entity (such as a charity, business, religious organization, funeral home, etc.), trust, or estate. You may name more than one. All secondary beneficiaries listed will receive EQUAL SHARES (equal amounts) of your benefit if ALL of the primary beneficiaries are deceased. See the Naming a Beneficiary section for directions for naming a beneficiary. You must list the percentage in the same box as the beneficiary’s name.

7. Unless you specify what benefit this form applies to, ETF will apply the benefits payable upon your death from this form to all benefit plans and accounts administered by ETF.

This form does not apply to the Wisconsin Deferred Compensation Program. Use the WDC Online Beneficiary Form to designate who will receive your WDC benefits upon your death.

If you wish to designate different beneficiaries for separate benefit plans or accounts, please contact ETF toll free at 1-877-533-5020 to request forms and special instructions.

8. Sign and date your form to have it accepted by ETF. If your form is not signed and dated, ETF cannot validate your form.

Fax your completed form to: (608) 267-4549

Mail your completed form to:

Wisconsin Department of Employee Trust Funds

P.O. Box 7931

Madison, WI 53707-7931

Call 1-877-533-5020 (toll free) if you have any questions or need help filling out your form.

A beneficiary is a person(s) or entity you name to receive benefits upon your death.

You may NOT name the individual, entity, trust or estate more than once on the form. For example, in the primary and secondary areas.

If you don’t file a beneficiary designation with ETF, your benefits will be paid out in the order called “standard sequence” which is part of Wisconsin law. Payment is made to the person or persons in the lowest numbered group that contains one or more living persons.

Group 1. Your surviving spouse or domestic partner.

Group 2. Your children (biological or legally adopted). If one of your children dies before you, that child’s share is divided among that deceased child’s children.

Group 3. Your parent(s)

Group 4. Your brother(s) and sister(s). If one of your siblings dies before you, that sibling’s share is divided between your deceased sibling’s children.

If there are no survivors in Groups 1 through 4, any death benefits will be paid to your estate.

Back to top of Naming a Beneficiary

You may assign a percentage of your benefit to your beneficiaries. The percentages listed must equal 100%. To assign percentage to a beneficiary, put the percentage before or after their name. For example:

50% to Jane Doe

50% to John Doe

Jane Doe 25%

John Doe 25%

Jason Doe 50%

Back to top of Naming a Beneficiary

ETF will pay the child’s court-appointed guardian, or the person ETF calls the child’s “natural guardian.” This is the person providing for or caring for the child, such as the child’s parent. ETF can also pay into a Uniform Transfer to Minors Account (UTMA) for the child.

Back to top of Naming a Beneficiary

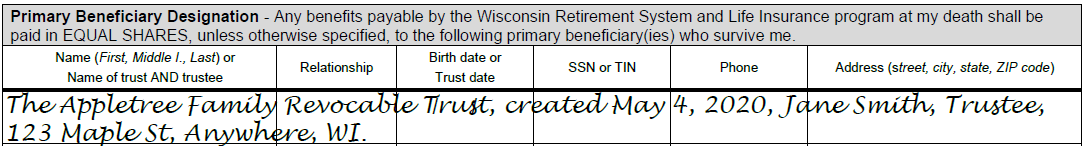

Provide the following information on the beneficiary designation:

If you are the trustee of your own trust, you must provide the name and address of a successor trustee for us to contact after your death

The purpose of including the trustee’s name is to give ETF the name of a person to contact after your death, in order to locate the trust. ETF may reject your designation if a trust is named as a secondary beneficiary and you have named as trustee a person who is named as a primary beneficiary. In that case, please provide a successor trustee or other contact person.

The Appletree Family Revocable Trust, created May 4, 2020, Jane Smith, Trustee, 123 Maple St, Anywhere, WI. [name and address of successor trustee (if necessary)]

If you name a trust as your beneficiary, please do not include any trust paperwork along with your beneficiary form. ETF does not need this paperwork at this time.

Back to top of Naming a Beneficiary

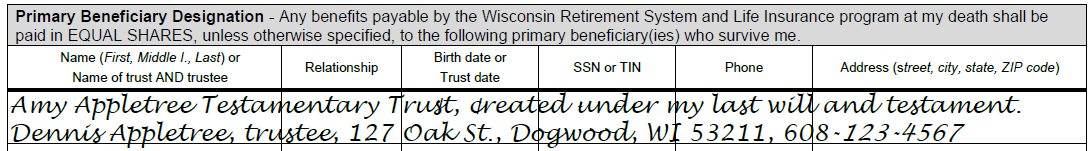

Your testamentary trust is created by your last will and testament, and does not come into existence until after your death.

You must provide ETF with enough information that ETF can find and identify the trust at the time of payment to the trust. You must provide the following information on the beneficiary designation:

The purpose of including the trustee’s name is to give ETF the name of a person to contact after your death, in order to locate the trust. ETF may reject your designation if a trust is named as a secondary beneficiary and you have named as trustee a person who is named as a primary beneficiary. In that case, please provide a successor trustee or other contact person.

You can name your own testamentary trust as your beneficiary by including it on the beneficiary form in the following format. You cannot name someone else’s testamentary trust.

Amy Appletree Testamentary Trust, created under my last will and testament. Dennis Appletree, trustee, 127 Oak St., Dogwood, WI 53211, 608-xxx-xxxx

Back to top of Naming a Beneficiary

If you name a subtrust as a beneficiary, you must provide ETF with enough information so that ETF can identify the subtrust at the time of payment. You must provide the following information on the beneficiary designation:

The purpose of including the trustee’s name is to give ETF the name of a person to contact after your death, in order to locate the trust. ETF may reject your designation if a trust is named as a secondary beneficiary and you have named as trustee a person who is named as a primary beneficiary. In that case, please provide a successor trustee or other contact person.

Davis-Dogwood Children’s Trust created under the Davis-Dogwood Revocable Trust dated 01/23/2020, Jane Smith, Trustee, 123 Maple St, Anywhere, WI. [name and address of successor trustee (if necessary)]

Back to top of Naming a Beneficiary

Provide the following information on the beneficiary designation:

Back to top of Naming a Beneficiary

You can include children who are not yet born (or adopted) by writing in the following statement:

This will include all marital and non-marital children (if any relevant paternity is established), whether the child’s date of birth is before or after your date of death. You may substitute "grandchildren" for "children" in the above example.

Alternatively, you can submit a new beneficiary designation form to us with any new children. Childbirth or adoption is a great time to review your beneficiary designation.