Due to 2023 Wisconsin Act 4, county correctional officers (jailers) who are categorized as general employees will become protective occupation employees as of January 1, 2024, under the Wisconsin Retirement System, unless they opt out.

Jailers will not be impacted by Act 4 if they are categorized as protective occupation employees (33) before the January 1, 2024 effective date, and remain in that category. The window for existing county jailers to opt out of the Act 4 Protective County Jailer employment category (new Category 43) closed on March 1, 2024. This means that it is no longer possible for existing county jailers to change their employment category. Please see the updated information below in the Employer Checklist section for impacts on county jailers hired on or after January 1, 2024 or those who work for an employer who opts into Act 4 after January 1, 2024.

Employers are responsible for categorizing employees based on the job duties they perform. If an employer determines that employees meet the criteria to be enrolled in a different employment category, the employer must terminate the old category and enroll employees in the new category. See chapter 4 in the WRS Administration Manual (ET-1127) for more information.

This page is a resource for county employers to learn about the implementation of 2023 Wisconsin Act 4 (Jailer Law).

Employer Checklist

- Review the 2023 Wisconsin Act 4 for Jailers page to learn about the law and how it will impact your employees. You have the option to opt into this law by recategorizing your jailers as general employees. This page describes the effects of that decision.

- Share the 2023 Wisconsin Act 4 for Jailers page with your impacted employees. Ensure your employees know:

- Their decision is permanent if they continue to work for your county.

- The deadline to make their decision.

- What happens if they do nothing.

- How their decision will impact their take-home pay, retirement benefits, and duty disability insurance eligibility.

- For any county jailers first hired on or after January 1, 2024 at a county that is impacted by or who opted into Act 4 OR for any county jailers currently working in a county that has opted into Act 4 after January 1, 2024, distribute the County Jailer Election of Protective or General Category Status (ET-2440) form to your jailers so they can record their decision.

- County jailers hired on or after January 1, 2024 at counties who were impacted or who opted into Act 4 as of January 1, 2024 are required to complete and return to you within 60 days of their hire the County Jailer Election of Protective or General Category Status (ET-2440) form.

- For counties that choose to opt into Act 4 after January 1, 2024, county jailers will be required to submit the County Jailer Election of Protective or General Category Status (ET-2440) form within 60 days of their employer opting in.

- Submit completed forms to etfsmbemployerWRS@etf.wi.gov.

- Retroactively collect employee-required contributions and update the employment category for jailers who have elected protective classification or who have not opted out once the employee's 60 day opt-out window ends.

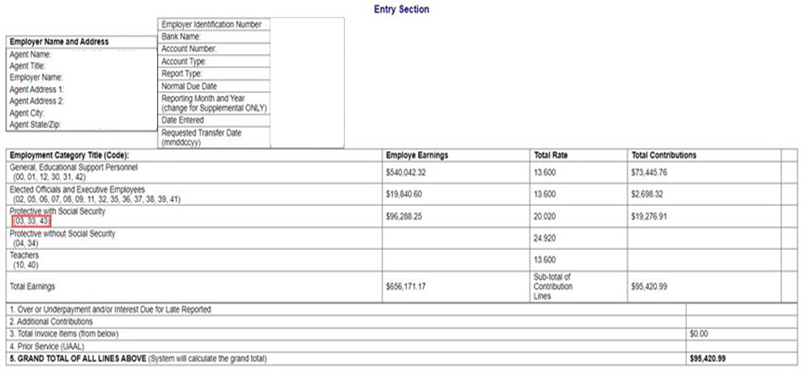

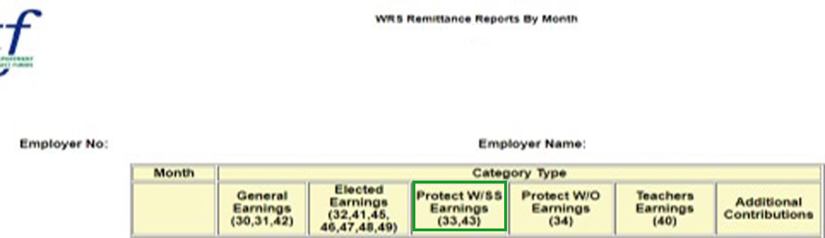

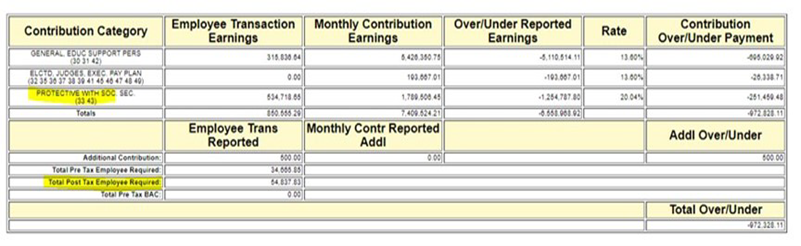

- Complete any remittance adjustments that are needed due to category changes by offsetting the earnings in a future remittance report. For example, if you had an employee whose earnings were reported in the general category, but they have elected or not opted out after their 60 days decision window and are now retroactively an Act 4 protective county jailer, you will subtract any earnings previously reported in Category 30 and will add those same earnings to Category 43 when processing your next WRS Monthly Retirement Remittance Report.

Employment Category and Contribution Changes

Employment code 43 will be used for Act 4 protective jailers. Separating Act 4 protective jailers from other protective occupation employees will ensure that contributions and benefits are handled correctly in ETF's systems.

All jailers should remain categorized as general employees until their 60-day decision window has passed and you have received their opt-out form. At that point, retroactively collect employee-required contributions and update the employment category for jailers who have elected protective classification or who have not opted out. Complete any needed remittance adjustments as well after the 60-day decision window has passed.

Employment category and employee-required contribution percentage changes should date back to the employee's start date for those hired on or after January 1, 2024 at counties impacted by or who opted into Act 4, OR the date a county opts into Act 4 if after January 1, 2024.

Impacts

- Once a county jailer has made their selection to be either a protective category or general category employee, their selection cannot be changed once entered in the system – it is irrevocable.

- After the opt-out deadline has passed, the employee cannot change their employment category if they remain a jailer with their current employer.

- Becoming a protective occupation employee will affect the employee’s take-home pay, retirement benefits, and duty disability insurance eligibility.

Below shows a comparison of contribution rates for 2024. As a reminder, contribution rates are subject to change each year. Please see the Employers: WRS Contribution Rates page for current rates.

| General Employee | Act 4 Protective County Jailer | Protective Occupation Employee Not Impacted by Act 4 | |

|---|---|---|---|

| Employee Contribution | 6.9% | 14.3% | 6.9% |

| Employer Contribution | 6.9% | 6.9% | 14.3% |

| Total Contribution | 13.8% | 21.2% | 21.2% |

Transaction Processing

You can access WRS employer applications on the ETF Web Applications for Employers page. When applicable, category changes due to Act 4 will require a termination of the previous employment category, and an enrollment into the new category using the WRS Account Update Application.

| Trans Code | Description | Requirements |

|---|---|---|

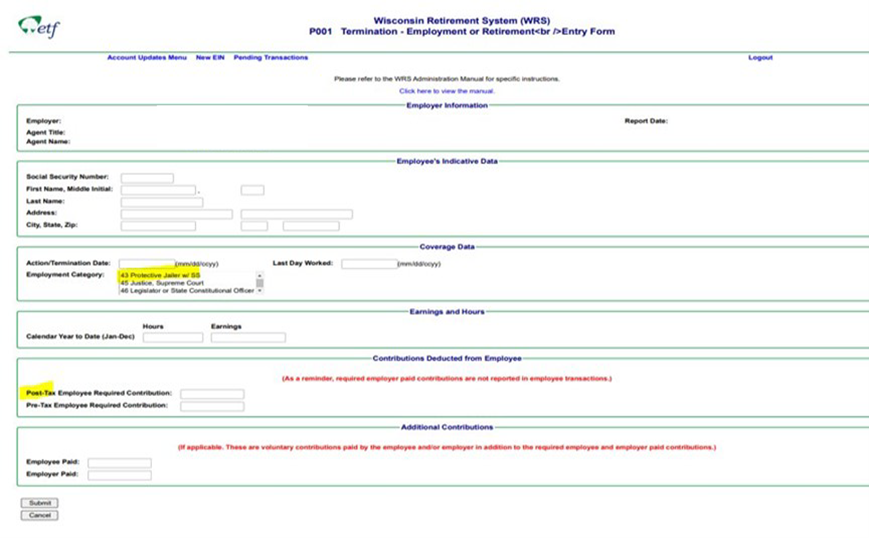

| P001 | Termination – Employment or Retirement, or for category changes: Use this transaction to terminate an employee’s previous employment category when changing employment categories. |

|

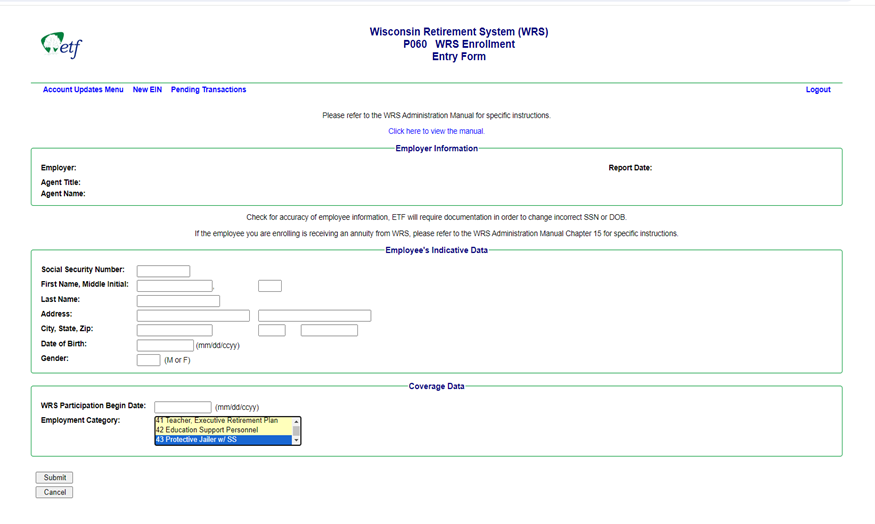

| P060 | WRS Enrollment: Use this transaction to enroll an employee into a new employment category when changing employment categories. |

|

* All jailers should remain categorized as general employees until after the employee's 60 day opt-out window has passed. At that point, retroactively collect employee-required contributions and update the employment category for jailers who have elected protective classification or who have not opted out. Employment category and employee required contribution percentage changes should date back to the employee's start date for those hired on or after January 1, 2024 at counties impacted by or who opted into Act 4, OR the date a county opts into Act 4 if after January 1, 2024.

Employee-Required Contributions

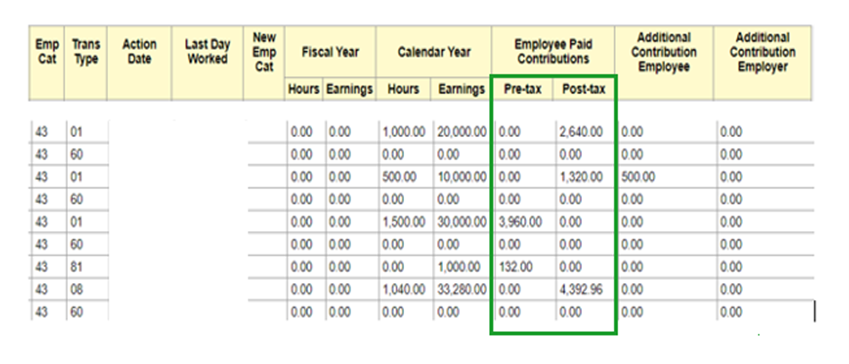

Required contributions deducted from Act 4 Protective Jailers (43) can be either pre- or post-tax depending on the specifics of the employee. It is important that you are collecting contributions correctly and reporting them in remittance reporting and transaction reporting accurately:

| Employee-Required Contributions | If the employee: |

|---|---|

| Pre-tax | did not previously work at the county in WRS employment before becoming an Act 4 protective county jailer, or worked in WRS-participating position at that county but took a lump-sum benefit from the WRS. |

| Post-tax | previously worked at the county in WRS employment before becoming an Act 4 protective county jailer and did not take a lump-sum benefit from the WRS. |

System Changes

The WRS Account Update Application has had edits made to allow for post-tax employee required contribution reporting and to add employment category 43. Below are examples of the P060 WRS Enrollment Entry Form and the P001 Termination Employment or Retirement Entry Form.

As a reminder, duty disability premiums paid are not reported or included in the employee paid required contributions for any employee transaction submitted as they are not part of an employee's WRS retirement benefit calculation. This means that for 2024, 14.3% of the employee's gross earnings would be reported in the employee-paid required contributions for Category 43 employees. Please see the references above in the Employee-Required Contributions section to understand which employees have their contributions paid, deducted, and reported as pre-tax and which employees have their contributions paid, deducted, and reported as post-tax in employee transactions.

The WRS Contribution Remittance Entry Application has been updated to include category 43.

Updates have been made to applicable reports within the WRS Earnings Reports (On-going) Application to include reference to category 43.

WRS Earning/Contribution Reconciliation

WRS Employee Transaction Detail

Questions

If you have questions about the law after reviewing the resources above, please email etfsmbemployerWRS@etf.wi.gov